US Bitcoin ETFs will quickly catch as much as gold ETFs in measurement in the event that they keep their present accumulation fee. Bloomberg ETF analyst Eric Balchunas suggests these funds might eclipse gold ETFs by Christmas.

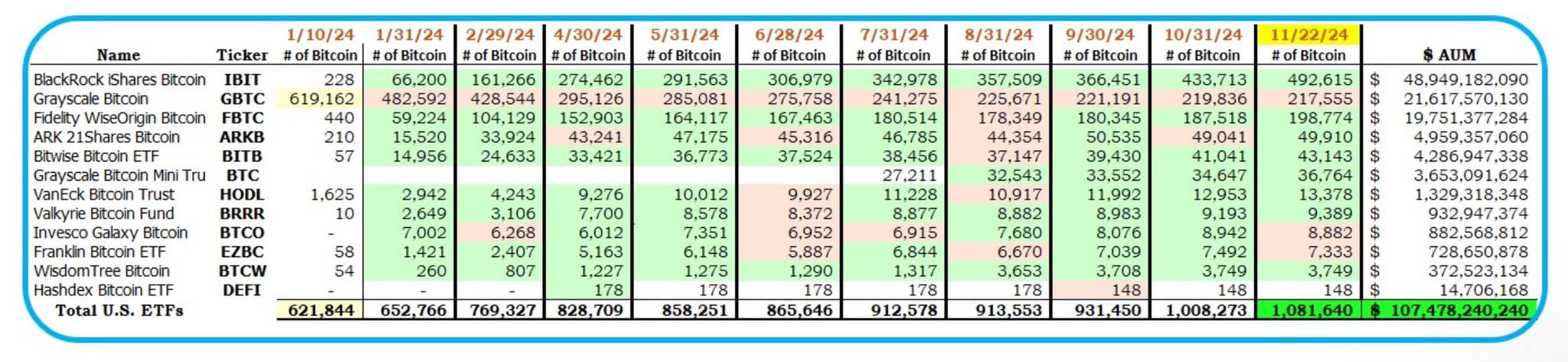

As of November 23, Bitcoin ETFs within the US reached $107 billion in belongings, which represents round 86% of the entire internet belongings of gold ETFs, in keeping with knowledge mixed by Balchunas and HODL15Capital.

“They solely lag gold ETFs by $23b, good shot to surpass by Xmas,” Balchunas said.

Bitcoin ETFs are closing the hole with Satoshi Nakamoto. These funds presently maintain roughly 98% of Satoshi’s estimated Bitcoin stash, with a excessive probability of overtaking the Bitcoin creator to grow to be the world’s largest Bitcoin holder subsequent week.

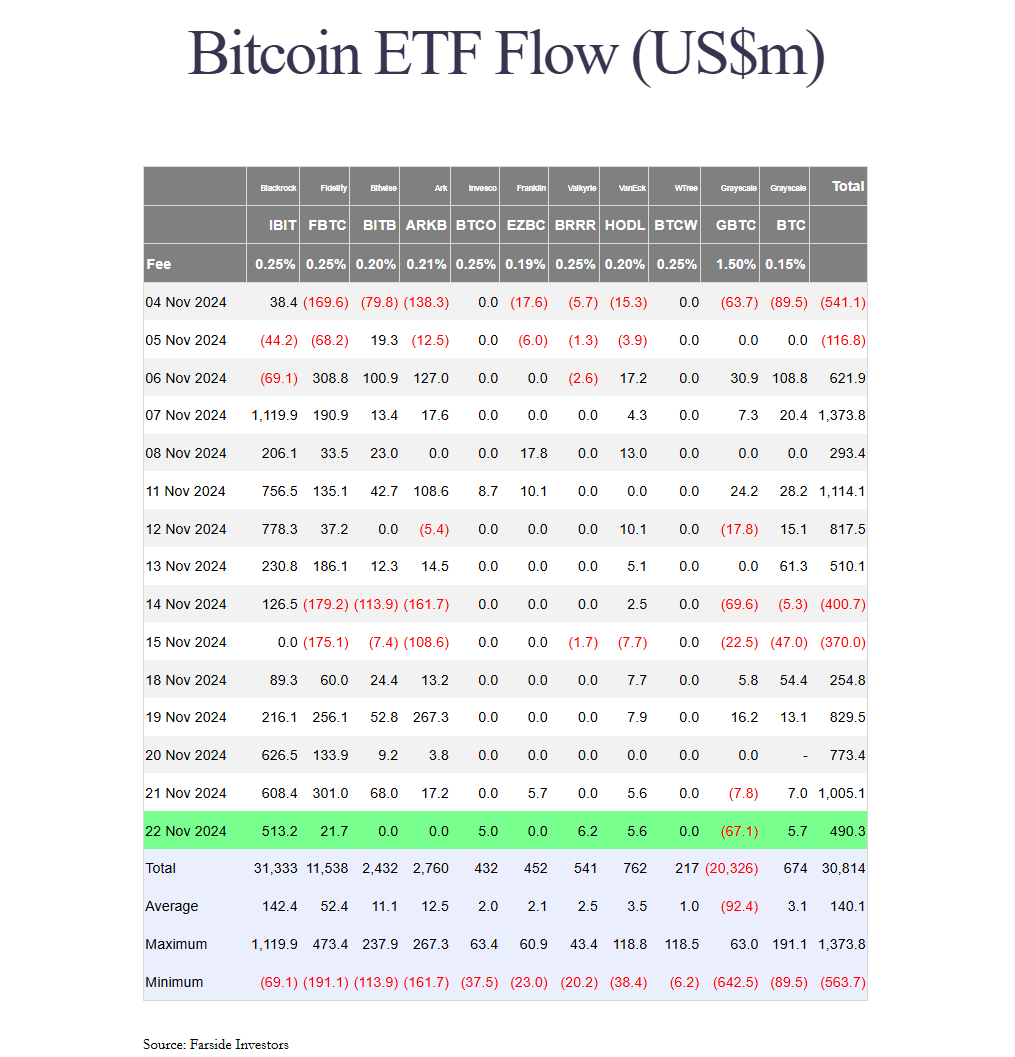

This week alone, US spot Bitcoin ETFs netted round $3.3 billion in internet inflows, with BlackRock’s iShares Bitcoin Belief (IBIT) capturing round 62% of the entire, Farside Traders’ knowledge exhibits.

IBIT continues to widen hole with BlackRock’s iShares Gold Belief (IAU) in internet belongings. As of November 22, IBIT held $48,4 price of Bitcoin whereas IAU’s belongings had been valued at round $34 billion.

Bitcoin’s surge raises issues about stability in comparison with gold

On Friday, the world’s largest crypto asset set a brand new all-time excessive of $99,500, approaching the six-figure mark. For Bitcoin advocates, the bull market continues to be in its early phases.

VanEck’s goal for Bitcoin this cycle is $180,000. The asset supervisor reiterated its projection in a latest report, supported by bullish indicators like funding charges, Relative Unrealized Revenue (RUP), and retail curiosity.

Nonetheless, State Road, managing over $4 trillion in belongings, thinks traders have gotten overly optimistic about Bitcoin’s potential, and overlooking the steadiness and long-term worth that gold gives.

George Milling-Stanley, chief gold strategist at State Road International Advisors, warns that the present Bitcoin rally might create a deceptive sense of safety amongst traders. In contrast to gold, which has a protracted historical past of being a dependable retailer of worth, Bitcoin’s future is unsure, in keeping with the analyst.

“Bitcoin, pure and easy, it’s a return play, and I feel that individuals have been leaping onto the return performs,” Milling-Stanley advised CNBC.

Milling-Stanley stresses that Bitcoin promoters, who usually examine Bitcoin mining to gold mining, are making a false sense of similarity that mimics gold’s attract.

“There’s no mining concerned. That is a pc operation, pure and easy. However they referred to as it mining as a result of they needed to look like gold — possibly take among the aura away from the gold,” he added.

Whereas gold has loved a 30% year-to-date return, Bitcoin has stolen the present with a staggering 160% surge. Its market cap now eclipses that of silver and Saudi Aramco.